When it comes to trading in the forex market, one term that often gets thrown around is “slippage.” But what exactly is slippage, and why should you, as a trader, be concerned about it? Let’s dive into this essential topic that can significantly affect your trading experience and outcomes.

Slippage

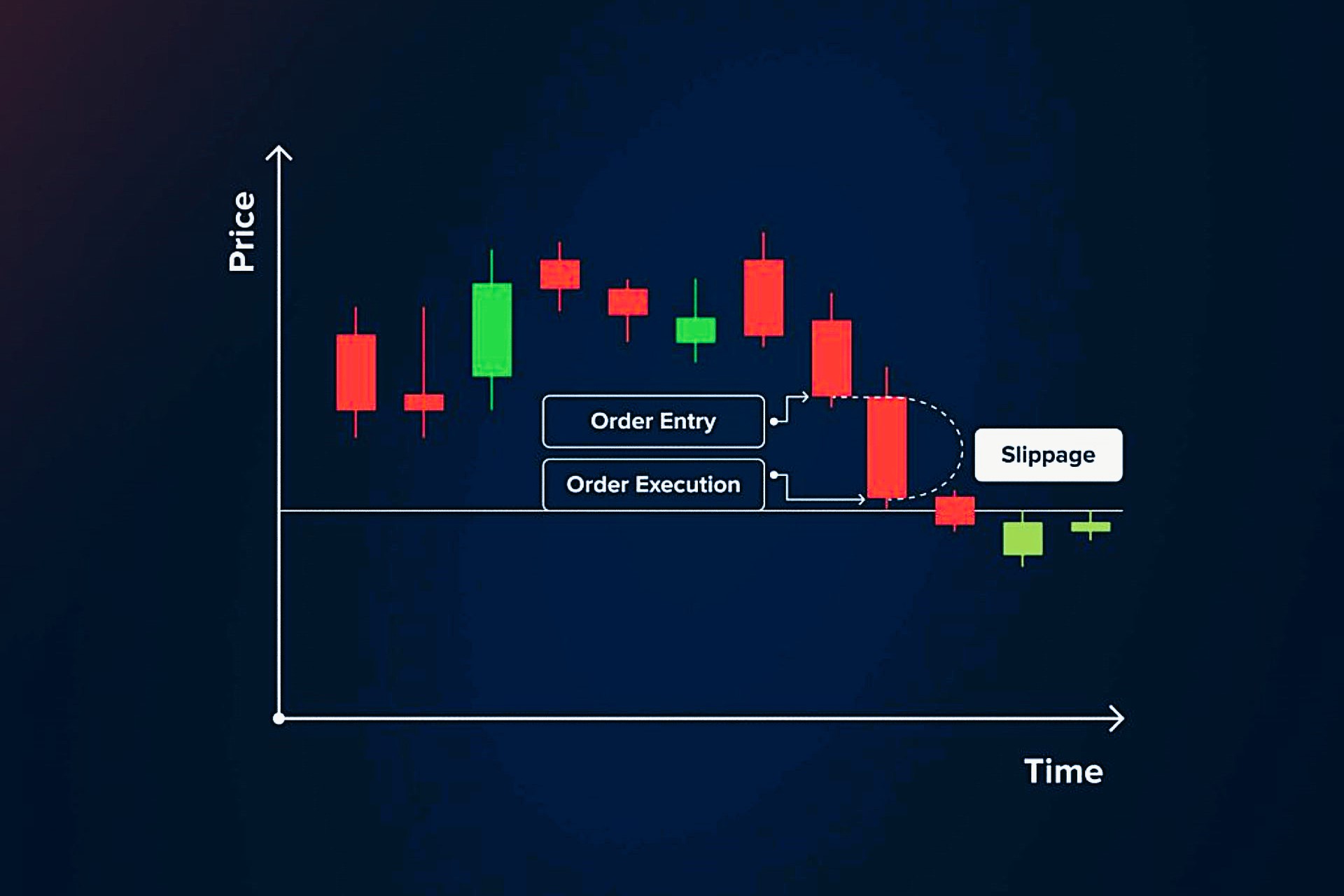

Slippage refers to the phenomenon where an order in the forex market is executed at a price different from what the trader expected. This often occurs when a market order is placed, which is designed to buy or sell a currency pair at the best available price. When you submit a market order, you might expect to buy a currency at a specific price; however, due to rapid market fluctuations or delays in execution, the order can fill at a significantly different price. For instance, think about a bustling street market where you spot a delicious snack at a certain price. You hurry to buy it, but by the time you reach the vendor, the price has changed—perhaps due to the vendor running low on stock or increasing demand from other customers. This discrepancy in the expected price versus the actual price at which your order executes is what slippage is all about.

Understanding slippage is essential for forex traders because it directly impacts their profitability and overall trading strategies. Slippage can occur in various market conditions, particularly during times of high volatility or low liquidity. If traders fail to account for slippage, they may find their expected profits dwindling or even turning into losses. By grasping the concept of slippage, traders can anticipate potential issues and devise strategies to mitigate its effects. It’s important to incorporate slippage into your trading plan, especially if you’re operating in fast-moving markets where prices can change in an instant. Recognizing how slippage can influence your trades allows you to make informed decisions, ultimately leading to improved outcomes and a healthier bottom line.

Types of Slippage

In the world of forex trading, slippage is a common occurrence that can significantly impact a trader’s results. However, not all slippage is detrimental; in fact, it can manifest in two primary forms: positive slippage and negative slippage. Understanding these two types is crucial for traders to manage their expectations and refine their trading strategies.

- Positive Slippage: This is when your order gets executed at a better price than you anticipated.

- Negative Slippage: This occurs when your order is filled at a worse price than expected.

Both types of slippage have implications for trading outcomes, and recognizing their nature can help traders navigate the complexities of the forex market more effectively.

Positive Slippage

Positive slippage is a favorable situation for traders, as it occurs when an order is executed at a price better than what was initially expected. This type of slippage can occur in fast-moving markets where prices fluctuate rapidly, allowing traders to benefit from a more advantageous entry or exit point.

For instance, if a trader places a buy order for a currency pair at $1.2000, but the order gets filled at $1.1995, this represents positive slippage. The difference of $0.005 per unit translates into an immediate benefit for the trader. Positive slippage can enhance profit margins and improve the overall trading experience.

Here are some key points regarding positive slippage:

- Enhanced Profitability:

- Positive slippage can lead to increased profits on trades because the trader is effectively entering the market at a lower price than anticipated. This advantage can accumulate over multiple trades.

- Improved Risk-Reward Ratio:

- By benefiting from positive slippage, traders can improve their risk-reward ratios. This means they might be able to take on slightly higher risks while still maintaining a favorable potential reward, leading to a more robust trading strategy.

- Market Conditions:

- Positive slippage is more likely to occur in volatile market conditions where price movements are rapid. Traders often experience this during major economic announcements or when unexpected news hits the market, causing sharp price movements.

- Psychological Boost:

- Experiencing positive slippage can enhance a trader’s confidence and morale, reinforcing a positive outlook on their trading strategies.

Negative Slippage

Negative slippage, in contrast, occurs when an order is executed at a less favorable price than what the trader expected. This situation can lead to decreased profitability and potentially turn a winning trade into a losing one, making it a frustrating experience for traders.

For example, if a trader sets a buy order for a currency pair at $1.2000 but the order fills at $1.2010, they have experienced negative slippage. This $0.010 difference can significantly impact the overall performance of a trade, especially in cases where tight stop-losses are in place.

Here are some critical aspects of negative slippage:

- Reduced Profits:

- Negative slippage can diminish expected profits, especially in a market with narrow profit margins. The trader may find that the potential gains from a trade are significantly less than anticipated, leading to disappointment.

- Increased Losses:

- In scenarios where traders rely on precise entry points, negative slippage can turn a winning trade into a loss. This is particularly concerning for scalpers or short-term traders who operate on tight stop-losses and small profit targets.

- Market Volatility:

- Negative slippage is most common in highly volatile markets, where rapid price movements can make it difficult to execute orders at the desired price. Economic news releases or geopolitical events often trigger such volatility.

- Emotional Impact:

- Encountering negative slippage can lead to frustration and emotional distress for traders. It may cause them to second-guess their strategies or lead to impulsive trading decisions in an attempt to recover lost profits.

- Mitigation Strategies:

- Traders can adopt certain strategies to minimize the impact of negative slippage, such as using limit orders instead of market orders, trading during times of high liquidity, and closely monitoring economic calendars to avoid trading during volatile periods.

Causes of Slippage

Slippage can occur for a variety of reasons in the forex market, each connected to the unique characteristics and dynamics of this financial landscape. Recognizing these causes is crucial for traders who want to mitigate the effects of slippage and optimize their trading strategies. Below are some of the most common causes of slippage.

Market Volatility

One of the primary causes of slippage in the forex market is market volatility. The forex market is notorious for its rapid and unpredictable price movements, which can be triggered by various factors, including economic announcements, geopolitical events, and changes in market sentiment. During periods of high volatility, such as when major economic data is released or during political unrest, prices can swing dramatically within seconds. This rapid fluctuation means that the price at which a trader wishes to enter or exit a position can change significantly before their order is executed, leading to slippage.

Traders who enter or exit the market during these volatile times are particularly susceptible to experiencing slippage. For instance, if a trader places a market order during the release of crucial economic data, they may find that the price has changed by the time their order is filled. This unpredictability can result in negative slippage, where the trader buys at a higher price or sells at a lower price than expected. In such circumstances, it becomes essential for traders to be aware of the economic calendar and to adjust their trading strategies accordingly to minimize the risk of slippage during periods of heightened market activity.

Delays in Order Execution

Another significant cause of slippage is delays in order execution. These delays can occur for various reasons, including technical issues with trading platforms, high trading volumes, or network connectivity problems. When a trader places an order, the execution relies on the trading platform processing that order promptly. If there is a delay—whether due to a slow internet connection, server overload, or system malfunctions—the trader may find that the market price has shifted by the time their order is executed. This situation can lead to unfavorable prices that do not align with the trader’s expectations.

Moreover, high trading volumes can exacerbate these delays. During periods of increased activity, such as during major market openings or when significant news events unfold, the number of buy and sell orders can surge. Trading platforms may become overwhelmed, causing a backlog in order processing. In such instances, traders may experience slippage as their orders are executed at prices that reflect the market’s movement during the delay rather than at the price they intended. To minimize the impact of delays, traders can consider using limit orders, which allow them to set specific price points for their trades, thereby providing more control over execution.

| Cause of Slippage | Description | Impact on Traders |

| Market Volatility | Sudden price movements due to economic announcements or geopolitical events can lead to slippage. | Can lead to unexpected gains or losses, affecting overall strategy. |

| Delays in Order Execution | Technical issues or high trading volumes can cause delays in order execution, resulting in trades being filled at less favorable prices. | Increases risk and uncertainty, potentially leading to emotional reactions. |

| Impact on Trade Outcomes | Even small slippage can significantly affect profitability, making it crucial for traders to account for it in their calculations. | Miscalculations may occur, leading to losses and adjustments in strategy. |

| Emotional Effects | Slippage can create frustration and uncertainty, prompting impulsive decisions that stray from a trader’s plan. | Heightened stress and potential for poor decision-making. |

How Slippage Affects Forex Traders

Slippage can have profound effects on forex traders, influencing not only their trading performance but also their psychological well-being. Understanding these impacts can help traders better prepare for the realities of the market and develop strategies to manage their responses to slippage.

Impact on Trade Outcomes

For many traders, even a small amount of slippage can significantly affect their overall trading strategy and results. When slippage occurs, the difference between the expected price and the actual execution price can lead to unexpected losses or gains. For instance, a trader who anticipates a certain profit from a trade may find that slippage erodes their expected return, making it vital to account for this factor when calculating potential profits. Consequently, traders must factor in slippage when developing their risk management strategies, as failing to do so can lead to miscalculations and unforeseen losses.

In addition to affecting individual trades, slippage can also influence a trader’s overall performance over time. For traders who execute multiple trades within a day, cumulative slippage can accumulate, resulting in a significant impact on their bottom line. This underscores the importance of adopting a proactive approach to trading, where slippage is taken into consideration as part of the broader trading strategy. By implementing measures to manage slippage, such as setting realistic profit targets and using stop-loss orders, traders can work to mitigate its effects and enhance their trading outcomes.

Emotional Effects of Slippage

Experiencing slippage can also have significant emotional effects on traders. The frustration and uncertainty that accompany slippage can create stress, leading to impulsive decisions that deviate from a trader’s established strategy. For example, if a trader experiences negative slippage on a critical trade, they may feel compelled to enter a new position hastily in an attempt to recover their losses. This kind of reaction can result in a cycle of emotional trading, where decisions are made based on feelings rather than sound analysis.

Understanding and anticipating slippage is essential for managing these emotional responses. By recognizing that slippage is an inherent part of trading, traders can develop a mindset that accepts the possibility of unfavorable outcomes. Additionally, having a well-defined trading plan that incorporates strategies for handling slippage can provide traders with a sense of control and reduce anxiety. Practicing mindfulness and maintaining a disciplined approach can further help traders navigate the emotional rollercoaster of trading, allowing them to stay focused on their long-term goals rather than being swayed by the immediate impacts of slippage.